How A Group of Reddit Users Changed the Stock Market Forever

Many people are confused by what is going on with WallStreetBets, GameStop stock, and Robinhood. I found this great post that really explained it better than any of these commercial news websites. So, I edited and added to the post and posted it to my Facebook page. My friends loved it so much; I am sharing it with you.

The Whole thing Explained

So this hedge fund called Melvin Capital wrote an article about how the smart investment move would be to short-sell GameStop stock. To put it simply, short-selling is essentially gambling that a stock’s price will drop. If it does, you make money. If it doesn’t, you end up paying out money for however much it goes up.

This little article that Melvin wrote pissed off a dark corner of the internet on Reddit called Wall Street Bets (WSB). WSB is a collection of Ritalin-addled lunatics who treat the stock market like a casino. These dudes will regularly gamble their life-savings on a single trade. It’s a glorious thing to watch.

It's truly insane and unprecedented.

The WSB crew has a weird fascination with certain stocks. They call them “meme stocks or stonks." Tesla is one, AMD is another, and GameStop is the most weirdly beloved meme stock. So for reasons that make sense only to the degenerates on WSB, Melvin trying to short-sell their meme was a declaration of war.

Yes, this is dumb. But it gets so freaking hilarious.

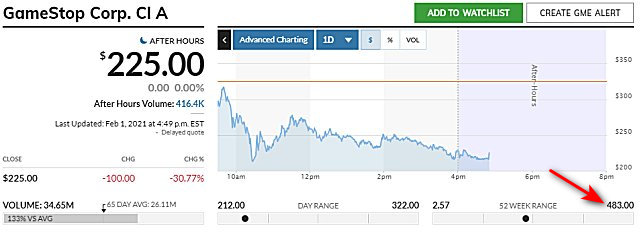

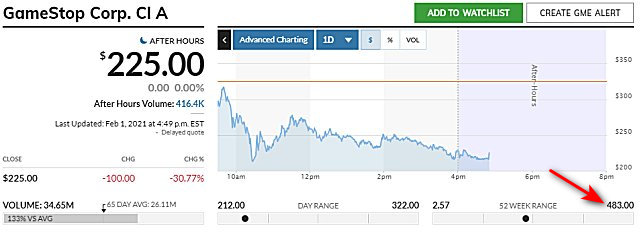

WSB decided to do a “short squeeze.” This is when you, with others, buy up that stock. With each purchase, the price actually goes up. Since Melvin was trying to short the stock for $20 per share, WSB wanted to get it as high above that price as humanly possible.

They got it up to $483 per share.

This means Melvin has to cover over $448 per share they bought. This came out to billions. Melvin Capital, overnight, was suddenly facing bankruptcy. Think about that. A bunch of self-identified degenerates on a freaking website were able to tank a freaking hedge fund.

That’s hilarious.

Well, the rich and powerful don’t like seeing us messing with one of their own. So Point72, another hedge fund, teamed up with a few other little funds, and they injected around THREE BILLION into Melvin Capital to keep them from spiraling. Essentially this meant the billionaire hedge fund crew were banding together to fight back against Wall Street Bets. Melvin Capital lost all of that three billion they were given.

It’s gone.

Point72 gave a little over a billion of that injection, which means that fund dropped from 17 billion to 16 billion. That means in less than 24 hours, WSB managed to all but ensured one hedge fund would die and drop another's value.

What we’re watching here with GameStop stocks is a bunch of rich people who are getting freaking wrecked, purely for entertainment, by the middle-class and poor people they regularly lobby against and treat like this. This is “eat the rich” via a phone app.

It’s “damn the man” with a meme-stock.

The Fallout

All of the trading apps had to suspend the bets on January 28th (remember bets, because this ain't investing). The traders forgot that while they were tanking hedge funds for billions, the companies they were buying through also had to cover it, especially given the margin buys. Margin is playing with the house money, just like a casino. The "casinos" ran out of money.

These companies, most notably Robinhood, had to get financing. Once they did, they limited how many shares of the WSB stocks you could buy, but you can sell all you want. Now you have fewer buyers and more sellers who panicked (rightfully so), and the two biggest stocks, AMC and GME, were tanking in early February.

The SEC is looking into Robinhood and other online traders. Some customers claim Robinhood sold their shares without permission. Others were angry that their buying power was cut off. Still, others, myself included, are leaving Robinhood because of slow trade executions. A class-action lawsuit against Robinhood has been filed.

Elon Musk can send a stock soaring with a tweet. And, he did. But I think he's feeling bad or taking some flack and took a break from Twitter.

What's Next?

Heading into February, the insanity continued with every news website in the world claiming WSB was targeting silver. They would be wrong. Numerous posts were made on WSB that silver wasn't of interest, but trying to buy more GME and AMC was the continued target. Yet, so-called legitimate news sites all ran with the silver story as silver barely moved at all. Since the buyer is restricted, it's impossible to run a stock up until those limits are lifted.

This isn't over. The WSB Reddit group grew from 2.2 million registered users to over 8 million in weeks. That adds up to at least 20 million people watching, waiting, hoping to cash on the next move.

We are assuming that many users will move to other apps taking the pressure off Robinhood, allowing them to let their users trade freely again, and allowing WSB to choose their next target. It takes a week or so to transfer accounts, so we'd keep an eye on the second week of February to see what, if anything, happens.

Then again, the WSB guys are pissed. There's a good chance they might pick a single stock like GameStop and try to push it to 500 again.

Final Thoughts

Most people buy stocks, collect a dividend sometimes, and hold it until someday you hopefully make a lot of money. If you want to get involved in stonks, we need to warn you that stonks can make you rich or destroy your life savings in a matter of days. People buying stonks aren't in it for retirement; they're in it for the thrill, to get rich quick and maybe even stick it to the man.

There's always been money to be made in the stock market. In a perfect world, everyone wins. Buyers, sellers, and companies. There's big money to be made for those who can throw caution to the wind.

Remember, WallStreetBets is the last place you want to go for stock advice, but it's a hell of a ride if you have the money and a lot of balls.

Similar:

What Does Stonk Mean?

comments powered by Disqus

The Whole thing Explained

So this hedge fund called Melvin Capital wrote an article about how the smart investment move would be to short-sell GameStop stock. To put it simply, short-selling is essentially gambling that a stock’s price will drop. If it does, you make money. If it doesn’t, you end up paying out money for however much it goes up.

This little article that Melvin wrote pissed off a dark corner of the internet on Reddit called Wall Street Bets (WSB). WSB is a collection of Ritalin-addled lunatics who treat the stock market like a casino. These dudes will regularly gamble their life-savings on a single trade. It’s a glorious thing to watch.

It's truly insane and unprecedented.

The WSB crew has a weird fascination with certain stocks. They call them “meme stocks or stonks." Tesla is one, AMD is another, and GameStop is the most weirdly beloved meme stock. So for reasons that make sense only to the degenerates on WSB, Melvin trying to short-sell their meme was a declaration of war.

Yes, this is dumb. But it gets so freaking hilarious.

WSB decided to do a “short squeeze.” This is when you, with others, buy up that stock. With each purchase, the price actually goes up. Since Melvin was trying to short the stock for $20 per share, WSB wanted to get it as high above that price as humanly possible.

They got it up to $483 per share.

This means Melvin has to cover over $448 per share they bought. This came out to billions. Melvin Capital, overnight, was suddenly facing bankruptcy. Think about that. A bunch of self-identified degenerates on a freaking website were able to tank a freaking hedge fund.

That’s hilarious.

Well, the rich and powerful don’t like seeing us messing with one of their own. So Point72, another hedge fund, teamed up with a few other little funds, and they injected around THREE BILLION into Melvin Capital to keep them from spiraling. Essentially this meant the billionaire hedge fund crew were banding together to fight back against Wall Street Bets. Melvin Capital lost all of that three billion they were given.

It’s gone.

Point72 gave a little over a billion of that injection, which means that fund dropped from 17 billion to 16 billion. That means in less than 24 hours, WSB managed to all but ensured one hedge fund would die and drop another's value.

What we’re watching here with GameStop stocks is a bunch of rich people who are getting freaking wrecked, purely for entertainment, by the middle-class and poor people they regularly lobby against and treat like this. This is “eat the rich” via a phone app.

It’s “damn the man” with a meme-stock.

The Fallout

All of the trading apps had to suspend the bets on January 28th (remember bets, because this ain't investing). The traders forgot that while they were tanking hedge funds for billions, the companies they were buying through also had to cover it, especially given the margin buys. Margin is playing with the house money, just like a casino. The "casinos" ran out of money.

These companies, most notably Robinhood, had to get financing. Once they did, they limited how many shares of the WSB stocks you could buy, but you can sell all you want. Now you have fewer buyers and more sellers who panicked (rightfully so), and the two biggest stocks, AMC and GME, were tanking in early February.

The SEC is looking into Robinhood and other online traders. Some customers claim Robinhood sold their shares without permission. Others were angry that their buying power was cut off. Still, others, myself included, are leaving Robinhood because of slow trade executions. A class-action lawsuit against Robinhood has been filed.

Elon Musk can send a stock soaring with a tweet. And, he did. But I think he's feeling bad or taking some flack and took a break from Twitter.

What's Next?

Heading into February, the insanity continued with every news website in the world claiming WSB was targeting silver. They would be wrong. Numerous posts were made on WSB that silver wasn't of interest, but trying to buy more GME and AMC was the continued target. Yet, so-called legitimate news sites all ran with the silver story as silver barely moved at all. Since the buyer is restricted, it's impossible to run a stock up until those limits are lifted.

This isn't over. The WSB Reddit group grew from 2.2 million registered users to over 8 million in weeks. That adds up to at least 20 million people watching, waiting, hoping to cash on the next move.

We are assuming that many users will move to other apps taking the pressure off Robinhood, allowing them to let their users trade freely again, and allowing WSB to choose their next target. It takes a week or so to transfer accounts, so we'd keep an eye on the second week of February to see what, if anything, happens.

Then again, the WSB guys are pissed. There's a good chance they might pick a single stock like GameStop and try to push it to 500 again.

Final Thoughts

Most people buy stocks, collect a dividend sometimes, and hold it until someday you hopefully make a lot of money. If you want to get involved in stonks, we need to warn you that stonks can make you rich or destroy your life savings in a matter of days. People buying stonks aren't in it for retirement; they're in it for the thrill, to get rich quick and maybe even stick it to the man.

There's always been money to be made in the stock market. In a perfect world, everyone wins. Buyers, sellers, and companies. There's big money to be made for those who can throw caution to the wind.

Remember, WallStreetBets is the last place you want to go for stock advice, but it's a hell of a ride if you have the money and a lot of balls.

Similar:

comments powered by Disqus